41 perpetual zero coupon bond

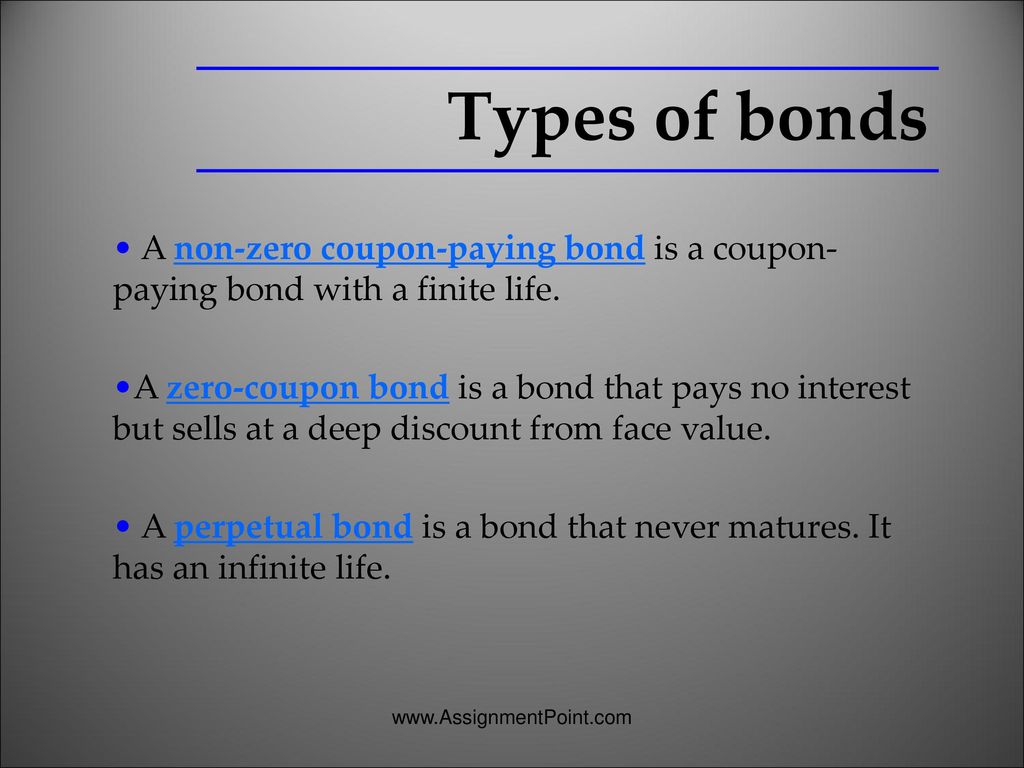

Autoblog Sitemap Electric-vehicle charging stations could use as much power as a small town by 2035 Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods.

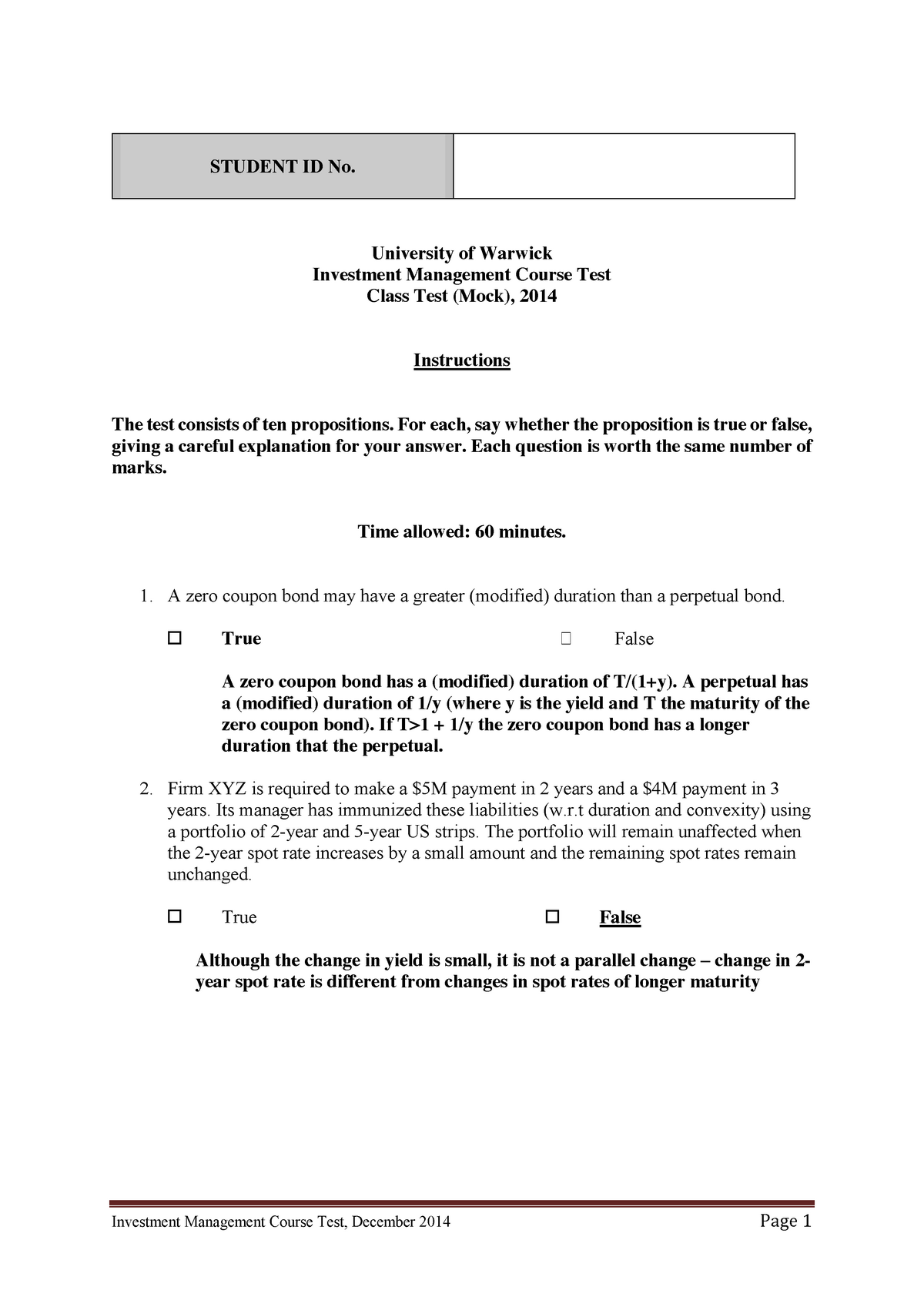

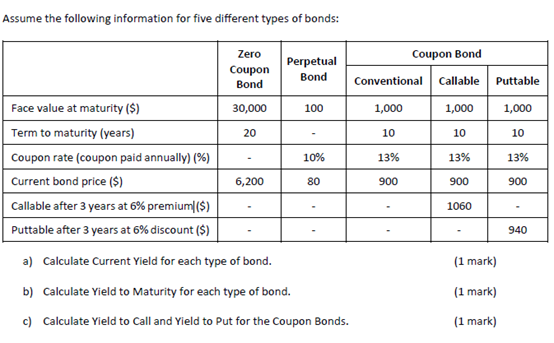

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds …

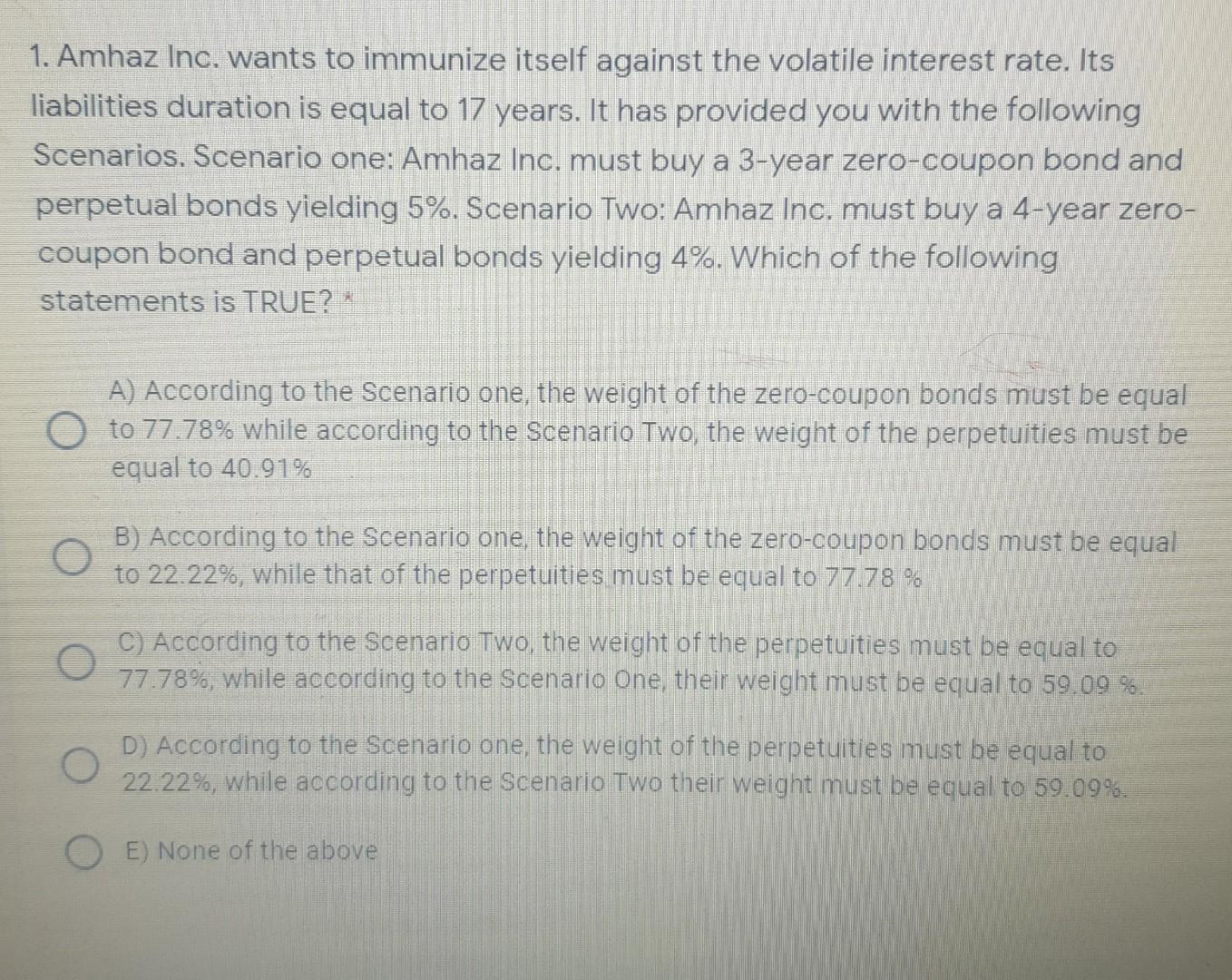

Perpetual zero coupon bond

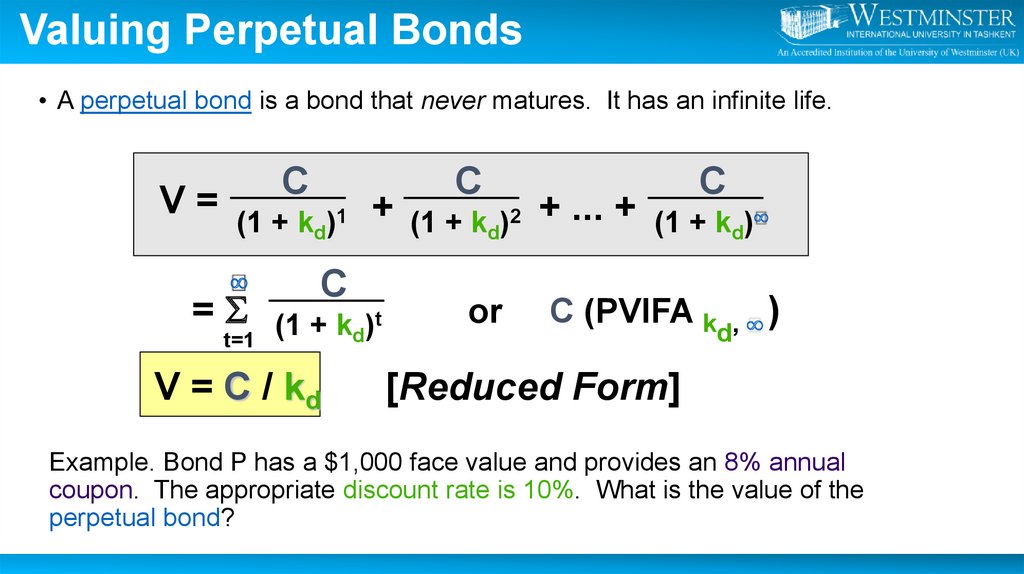

Perpetual Bond: Definition, Example, Formula To Calculate Value 19.3.2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, … Home | NextAdvisor with TIME The I Bond Rate Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read.

Perpetual zero coupon bond. About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve. Questia - Gale Questia. After more than twenty years, Questia is discontinuing operations as of Monday, December 21, 2020.

Home | NextAdvisor with TIME The I Bond Rate Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, … Perpetual Bond: Definition, Example, Formula To Calculate Value 19.3.2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 perpetual zero coupon bond"