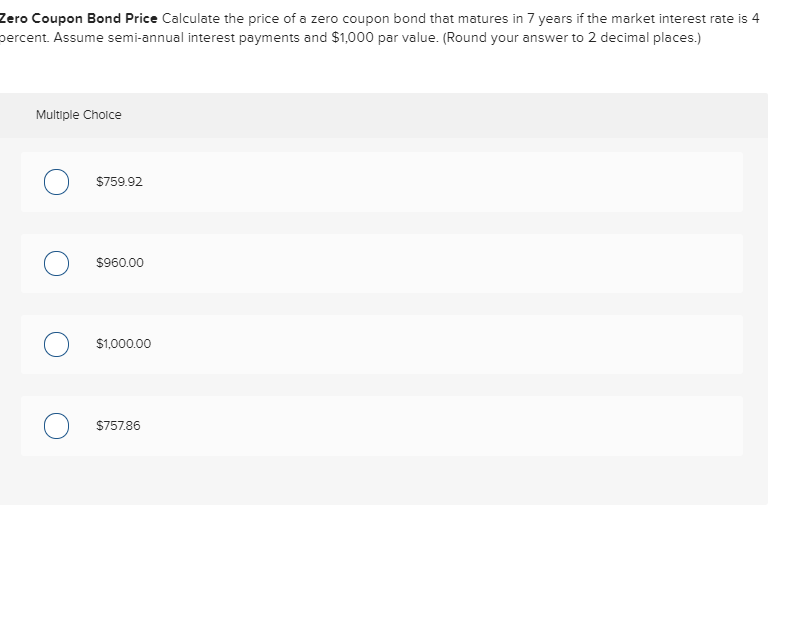

44 zero coupon bond price calculation

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. A bond selling at a discount will have a normalized price of less than ... A bond selling at a discount will have a normalized price of less than 100. T is the number of years left till the maturity of the bond. Let's calculate the current yield of a bond that has a par value of $5,000, market price of $5,500, 3 years left to maturity and a coupon rate of 10%. P = $5,500 NP = 110 T = 3.

› knowledge › zero-coupon-bondZero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Price Example Calculation. In our illustrative scenario, let’s say that you’re considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0%

Zero coupon bond price calculation

Zero Coupon Bond Calculator - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01 Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Step #3: Enter the bond's coupon rate percentage. Step #4: Enter the ... The yearly coupons on this bond are $200, the bond will reach maturity in 5 years, thus, calculate the yield to maturity of the bond. Therefore, the. Therefore, the. Jul 27, 2017 · Use the data already calculated for a stock with a liquidation value of $1,000, a market price of $850, a coupon rate of 5% and 15 years left to maturity to ...

Zero coupon bond price calculation. How to Calculate the Price of a Zero Coupon Bond Calculating Zero-Coupon Bond Price To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. Zero Coupon Bond: Formula & Examples - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value ; Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. What is the difference between zero-coupon and traditional coupon bonds? Zero-Coupon Bond Calculation - MYMATHTABLES.COM Formula for Zero Coupon Bond Price : A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate

Bond convexity - Wikipedia Calculation of convexity. Duration is a linear measure or 1st derivative of how the price of a bond changes in response to interest rate changes. As interest rates change, the price is not likely to change linearly, but instead it would change over some curved function of interest rates. The more curved the price function of the bond is, the more inaccurate duration is as a … › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows:... Zero Coupon Bond Calculator – What is the Market Price? The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; ... Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months; Substituting into the formula: Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Job Finder - Search for Jobs Hiring. Summation (Sum) Calculator. Percent Off Calculator - Calculate Percentage.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. ... This calculation relies only on the difference between market price and the coupon rate of the bond. ... (Zero Coupon Bonds) The accrued interest formula is: F * (r/(PY)) * (E/TP) Where:

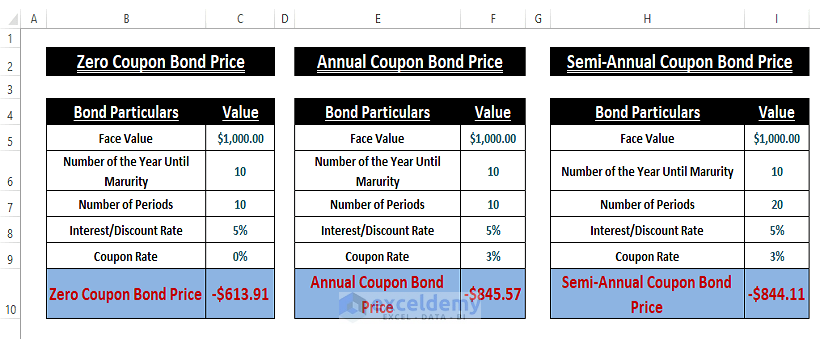

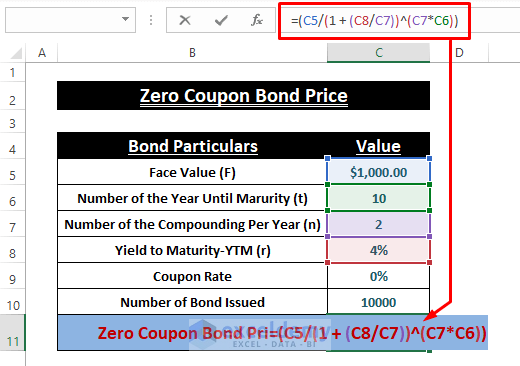

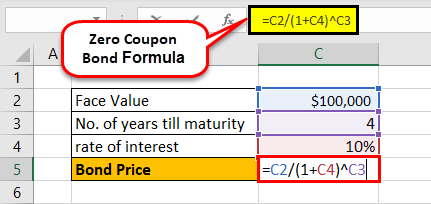

How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Zero-Coupon Bond Price Calculation Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Bond Pricing - Formula, How to Calculate a Bond's Price Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value. Each bond must come with a par value that is repaid at maturity. Without the principal value, a bond would have no use. The principal value is to be repaid to the lender (the bond purchaser) by the borrower (the bond issuer). A zero-coupon ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel; Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get ...

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia Consider first a $100 investment in each, which makes sense for the three bonds (the coupon bond, the annuity, the zero-coupon bond - it does not make sense for the interest rate swap for which there is no initial investment). Modified duration is a useful measure to compare interest rate sensitivity across the three.

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate. ... the yield calculation used is a yield to ... How to Calculate Yield to Maturity of a Zero ...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate. ... the yield calculation used is a yield to ... How to Calculate Yield to Maturity of a Zero ...

Zero-Coupon Bonds: Characteristics and Examples - Wall Street … Zero-Coupon Bond Price Example Calculation. In our illustrative scenario, let’s say that you’re considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0%

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

For the accrued interest - org.639deals.nl To calculate YTM on zero coupon bond, use Zero Coupon Bond Yield Calculator. Bond Details:. Aug 07, 2020 · This Calculator provides values for paper savings bonds of these series: ... Rate: The annual interest rate of the bond. Price per $100 face: The price of the security, expressed in units of $100 face value.For example, ...

Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. FAQ What is Zero Coupon Bond Value?

Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Oct 11, 2022 · NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Yield Curve - The Thai Bond Market Association 2. Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields.

Step #3: Enter the bond's coupon rate percentage. Step #4: Enter the ... The yearly coupons on this bond are $200, the bond will reach maturity in 5 years, thus, calculate the yield to maturity of the bond. Therefore, the. Therefore, the. Jul 27, 2017 · Use the data already calculated for a stock with a liquidation value of $1,000, a market price of $850, a coupon rate of 5% and 15 years left to maturity to ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

Zero Coupon Bond Calculator - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01

Post a Comment for "44 zero coupon bond price calculation"